Tips for Buying an EV at the end of the year

December 3, 2019//Comments Off on Tips for Buying an EV at the end of the year

December is a great month to take advantage of the Federal EV Tax Credit.

If you have been on the fence about purchasing an EV, now might be the perfect time. End-of-year deals and the federal ev tax credit may be good enough to make the move. It is snowy outside and we love being able to pre-warm the cabin of the car in the garage with no emissions or idling!

Here are two reasons why December is a great time to buy one of the many EV’s available today:

Tax credit can reduce tax liability.

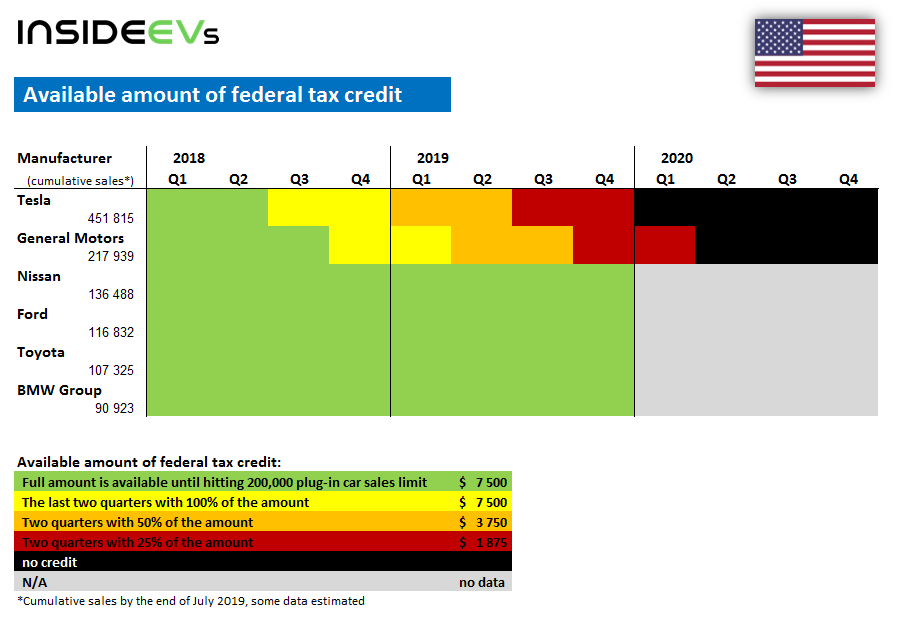

- The Federal EV tax credit is still available and ranges from $1,875 to $7,500 depending on the vehicle. Buying in December means you can take full advantage of the tax credit as soon as you file your taxes!

- As a reminder, if you don’t have a large enough tax liability, you can always lease the vehicle as a work around. The dealer will take the tax credit and reduce the base cost of the car. At that point you can continue to keep the lease, or buy out the remainder of the lease.

Tesla and GM lost their federal ev tax credit in 2020.

- Although the tax credit is still in full effect for most automakers, Tesla and GM have hit the threshold where the amount they get to offer is reduced each quarter. This means that Tesla vehicles delivered after Jan 1st 2020 are no longer eligible for the EV tax credit.

- For GM’s Chevy Bolt they are also in the ramp down of tax credits but are a quarter behind, so they will keep their $1,875 tax credit until the end of Q1 2020.

- No other manufacture has hit the 200,000 vehicle threshold so they are all still offering the full $7,500 credit on new electric vehicles. You can see how close each manufacture is to their 200,000 threshold here

If you have any questions, please reach out to Neil at Neil@envirocenter.org or call him at 541-385-6908 X12.