Energy

Solarize Deschutes, a Community-Driven Campaign Offers Discounted Solar to Deschutes County Residents

If you have been thinking about going solar, now is the time to get a bid while the Solarize Deschutes campaign is offering big discounts. The Environmental Center, Energize Bend,…

Read MoreThe Environmental Center Launches New, Free Home Energy Assessment Program

Bend, Ore.– As we head into another hot summer with a high likelihood of climate impacts such as wildfire smoke, many may be concerned about their home’s readiness to handle…

Read More10 Things I learned buying an EV in Central Oregon

This winter I found myself without a car and only a motorcycle to get around town in our Central Oregon snow storms. That is to say, I did not end…

Read MoreOLCV Releases 2023 Environmental Scorecard

This article has been copied directly from the Oregon League of Conservation Voters’ original post. Find the original page here: https://www.olcvscorecard.org/2023/ Environmental and Climate Progress: Despite Longest Republican Walkout in…

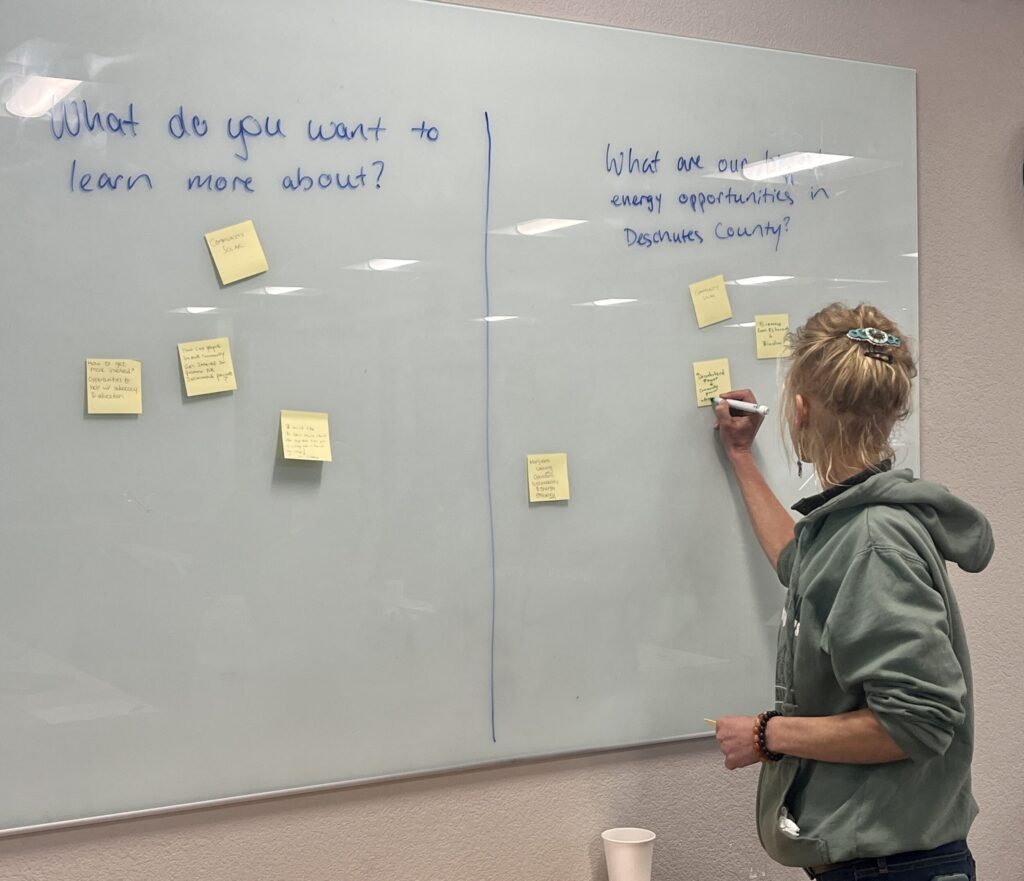

Read MoreCommunity Responds to Deschutes Energy Future

Deschutes Energy Future Launches August 2023 Last month, our Climate Solutions program launched the Deschutes Energy Future (DEF) initiative, an innovative pathway to develop a community-led energy plan for Deschutes…

Read MoreBend’s Home Energy Score Program Begins July 1st

Written by Matthew Schrader-Patton In the fall of 2022, the Home Energy Score Program was passed by the Bend City Council. In short, this program will require homeowners to have…

Read MoreOn firm financial footing, Oregon must invest in healthy, affordable, resilient homes and buildings in the face of the climate crisis

Original post written by: Brad Reed, Campaign Director, Building Resilience brad@buildingresilience.org, (971) 217-6813 On the heels of an encouraging revenue forecast today, a broad coalition is urging lawmakers to urgently…

Read MoreCity Hosts Home Energy Score Assessor Boot Camp

City Hosts Home Energy Score Assessor Boot Camp This information was sent out in a News Release April 5, 2023 The City of Bend is sponsoring a Home Energy Score…

Read MoreSave money and support clean energy with Oregon’s Community Solar Program!

What is the Oregon Community Solar Program? This unique program allows you to subscribe to a new Oregon Community Solar installation and use that electricity in your home. Anyone in…

Read MoreWhy Does TEC Support a Mandatory Home Energy Score Program?

Can you imagine buying a car today without knowing the miles-per-gallon efficiency rating? Especially these days, the MPG of a new car may have a significant impact on your willingness…

Read More